Thursday, January 30, 2025

How Much Does Concierge Medicine Cost, and Is It Worth It?

Concierge medicine is a healthcare model that provides personalized, high-quality care with better access to a physician—but how much does it actually cost, and is it worth the investment? While concierge medicine can seem expensive upfront, when compared to traditional insurance and out-of-pocket healthcare costs, it may actually save money while providing superior, preventative care. However, it’s not the right fit for everyone. Let’s break down the costs, the value, and who should consider making the switch.

Understanding the Cost of Concierge Medicine

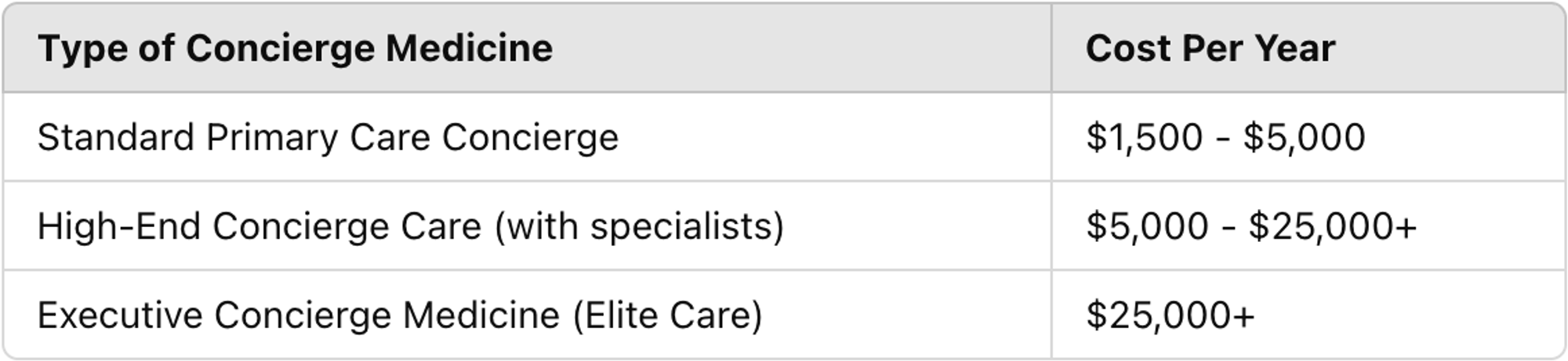

Concierge medicine operates on a membership-based model, where patients pay a fixed monthly or annual fee for enhanced access to their doctor. The cost varies widely based on the provider, location, and services included.

Typical Membership Fees

- Monthly costs can range from $100 to over $2,000.

- Some concierge practices offer tiered pricing, with basic memberships covering general primary care and premium memberships including advanced testing and home visits.

- Additional fees may apply for specialty care, hospitalizations, and lab work, depending on the provider's model.

What Does Concierge Medicine Cover?

Concierge medicine does not replace health insurance, but it significantly enhances primary care access and can reduce the need for expensive, reactionary medical care. Here’s what your membership fee typically covers:

Included Benefits:

- Unlimited doctor visits with little to no wait times

- Longer, in-depth appointments (often 30-60 minutes instead of the standard 10-15 minutes)

- 24/7 direct access to your physician (phone, text, or video calls)

- Preventative care and wellness planning

- Same-day or next-day appointments

- Coordinated specialist referrals

- House calls and extended services (depending on the practice)

What’s Not Covered:

- Emergency Room visits and hospital stays

- Surgical procedures

- Specialist care outside of your concierge provider's network

- Expensive diagnostic imaging (MRI, CT scans, etc.)

- Prescription medications (though many concierge doctors can help you get discounts)

Because concierge medicine doesn’t cover everything, many patients still pair it with a high-deductible health plan (HDHP) or catastrophic insurance to cover major medical expenses.

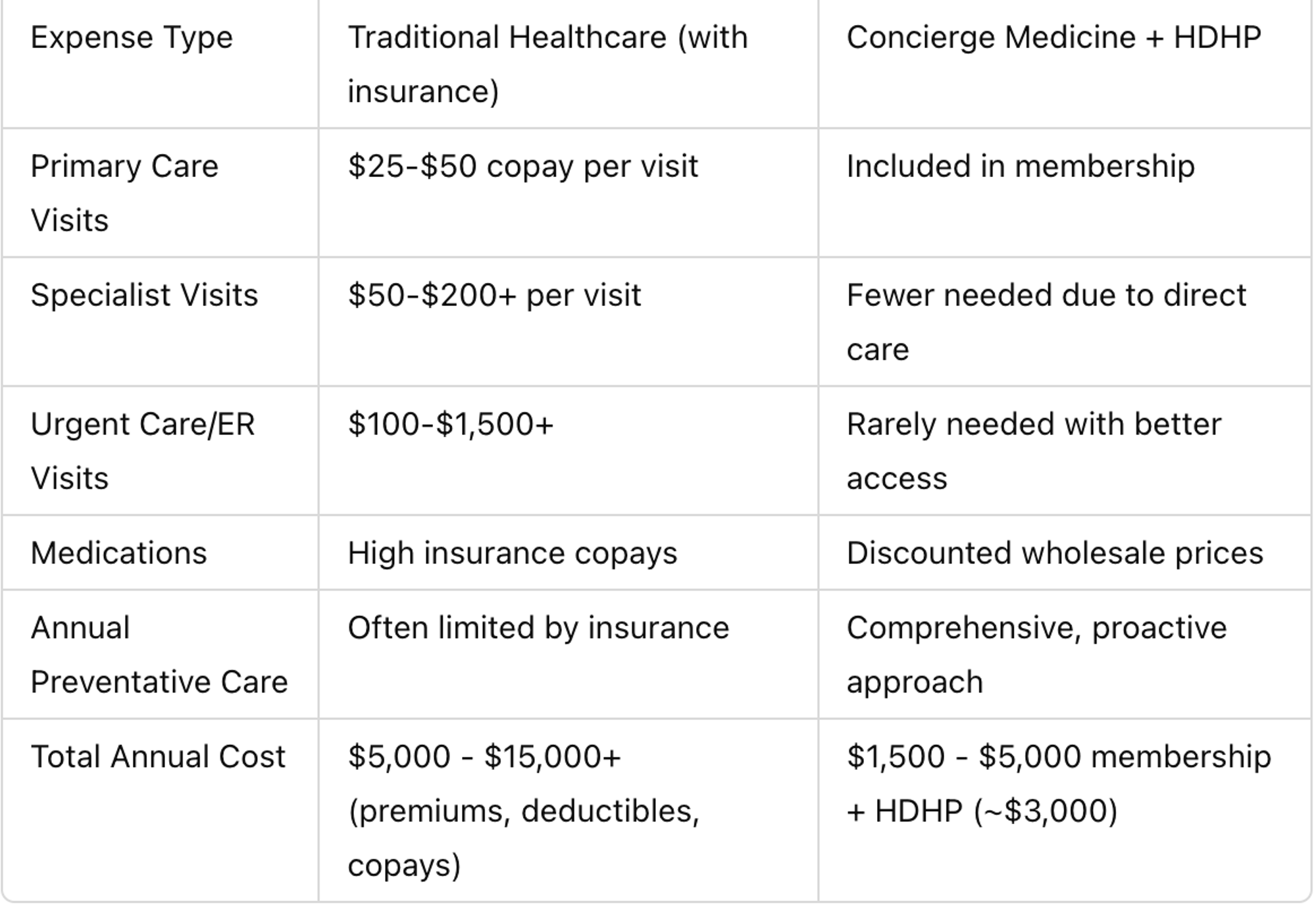

Is Concierge Medicine Actually Cheaper Than Traditional Insurance?

While concierge medicine is an out-of-pocket expense, many patients find that it saves money in the long run. Here’s how:

1. Lower Overall Healthcare Costs

- By focusing on preventative care, concierge medicine reduces the need for ER visits, urgent care, and specialist referrals.

- Patients with chronic conditions receive more proactive management, avoiding costly complications.

- Wholesale pricing on medications and labs is often available, saving hundreds or thousands per year.

2. Eliminating Insurance Hassles

- No copays, surprise bills, or denied claims.

- No need to navigate complex insurance networks.

- Physicians spend more time with patients, leading to better diagnoses and fewer unnecessary tests or referrals.

3. Less Missed Work & Increased Productivity

- Same-day appointments and direct access mean less waiting and faster treatment.

- Better overall health leads to fewer sick days and higher productivity.

Example Cost Comparison:

For many people, concierge medicine plus a high-deductible insurance plan costs the same—or even less—than traditional insurance alone.

Is Concierge Medicine Worth It?

Who Benefits Most from Concierge Medicine?

- Individuals with chronic conditions who need ongoing management

- Busy professionals who want convenient, direct access to their doctor

- Families who value personalized, proactive healthcare

- Those who are frustrated with traditional healthcare's long waits and impersonal service

- Patients who frequently use primary care services

Who Might Not Benefit?

- Those who rarely visit the doctor and prefer to keep low-cost insurance

- Patients who rely on insurance to cover all healthcare expenses

- People who require frequent specialist visits or hospital care that concierge medicine doesn’t cover

Final Thoughts: Making an Informed Decision

Concierge medicine offers exceptional healthcare access, personalized attention, and a focus on prevention, but it comes at a cost. When evaluating whether it's worth it, consider:

- Your healthcare needs – Do you frequently see a doctor? Do you have chronic conditions that require ongoing care?

- Your budget – Can you afford the out-of-pocket costs?

- Your frustration with traditional healthcare – Are you tired of waiting weeks for an appointment or feeling rushed during visits?

For those who value direct access, longer appointments, and preventive care, concierge medicine is often a cost-effective, higher-quality alternative to traditional insurance-based care. While not for everyone, it can be a game-changer for those who prioritize their health and time.